Loans Fundamentals Explained

Wiki Article

Not known Details About Payday Loan

Table of ContentsThe Buzz on Payday LoanThe Facts About Quick Payday Loan RevealedGet This Report about LoansA Biased View of Payday Loans

Your company might reject your request, however it's worth a shot if it implies you can avoid paying excessively high charges and also passion to a cash advance loan provider. Asking a loved one for help might be a difficult discussion, however it's well worth it if you're able to prevent the extravagant passion that comes with a payday advance loan. Quick Payday Loans of 2022.Ask your lending institution a lot of questions and also be clear on the terms. Strategize a payment plan so you can pay off the funding in a prompt way as well as prevent coming to be bewildered by the added expense. If you comprehend what you're entering and also what you need to do to get out of it, you'll pay off your loan quicker as well as reduce the influence of outrageous rates of interest and also fees.

What ever the factor you need the lending, before you do anything, you should comprehend the advantages and disadvantages of payday advance. Payday advance loan are small cash money car loans that are provided by short-term funding lenders. Like any type of monetary choice, there are pros and cons of payday advance. They are advertised as quick payday advance loan that fast as well as hassle-free in these situations - Quick Payday Loan.

Below are the benefits that consumers are choosing when making an application for payday advance. With these payday advance loan, getting cash rapidly is a function that cash advance financings have over its standard rivals, that require an application and then later on a check to submit to your bank account. Both the approval process and the cash may deliver in less than 24-hour for some candidates.

Things about Payday Loan

Pay stubs and also evidence of work are much more important to the authorization of your application than your credit report. Nearly any individual with a consistent task can look for a payday advance, after simply answering a handful of inquiries. These financing applications are likewise a lot extra basic than conventional alternatives, leaving area for the customer to be as exclusive as they need to be concerning their funding.

A quick online loan provider search will certainly motivate you to a selection of alternatives for little cash money fundings and rapid payday Payday Loan advance. While there are a number of pros and also cons of payday advance loan, on the internet lending institution accessibility makes this option an actual benefit for those that need cash money quickly. Some customers appreciate the privacy of the web loan providers that just ask minimal concerns, assess your revenue, and deposit cash money into your account quickly after you have actually electronically authorized your contract.

Little Known Questions About Loans.

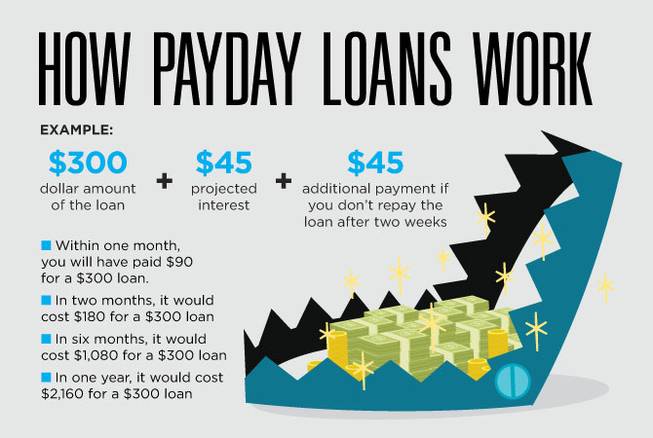

Like all great financing alternatives, there are concerning functions that stabilize out those attractive benefits. As easily accessible as something like a cash advance funding is, it can be something that is also excellent to be real. Because of the clients that these brief term lending lenders bring in, the disadvantages can be additional damaging to these consumers and also their monetary states (Payday Loans).Some customers find themselves with rates of interest at fifty percent of the loan, or even one hundred percent. By the time the funding is paid off, the amount borrowed as well as the rate of interest is a total amount of twice the initial loan or more. Because these rates are so raised, consumers locate themselves incapable to make the complete repayment when the next check comes, furthering their debt and burdening themselves monetarily.

Some of these brief term financing lenders will certainly add a cost for consumers that try to pay their financing off early to get rid of some of the interest. When the payday lending is contracted, they expect the payment based upon when a person is paid and also not earlier in order to collect the interest that will certainly be accumulated.

If the payday financing is unable to be paid in full with the following check, as well as the balance needs to surrender, the client can expect yet an additional cost that is similar to a late cost, charging them even more rate of interest essentially on the payday car loan. This can be troublesome for a family and also prevent them from being able to prosper with a car loan - Loans.

The Best Strategy To Use For Quick Payday Loans Of 2022

Many customers find these settlement terms to be ravaging to their funds and can be more of a concern than the requirement that caused the preliminary application for the financing. In some cases clients discover themselves incapable to make their cash advance settlements and also pay their costs. They compromise their repayment to the payday funding business with the hopes of making the repayment later.

As soon as a debt collection agency obtains your financial debt, you can anticipate they will call you usually for settlement using phone and also mail. Must the financial debt continue to linger, these debt collector might have the ability to garnish your earnings from your incomes till your unsettled financial obligation is built up. You can identify from the individuals specify policies - Payday Loans.

Report this wiki page